- Home

- About

- Legal Services

- Appellate Attorney

- Bankruptcy

- Business Buy/Sell and Corporate Law

- City County Government

- Civil Litigation & Lawsuits

- Construction & Builder Disputes

- Development

- Estate Planning

- Family Law

- Foreclosure Defense

- HOA Attorney

- Landlord-Tenant Law

- Mediators & Mediation

- Personal Injury

- Property Damage

- Real Estate

- Tax Law & Debt Relief

- Mediators

- Attorneys

- News

- Contact

- Home

- About

- Legal Services

- Appellate Attorney

- Bankruptcy

- Business Buy/Sell and Corporate Law

- City County Government

- Civil Litigation & Lawsuits

- Construction & Builder Disputes

- Development

- Estate Planning

- Family Law

- Foreclosure Defense

- HOA Attorney

- Landlord-Tenant Law

- Mediators & Mediation

- Personal Injury

- Property Damage

- Real Estate

- Tax Law & Debt Relief

- Mediators

- Attorneys

- News

- Contact

BANKRUPTCY & DEBT RELIEF ATTORNEYS

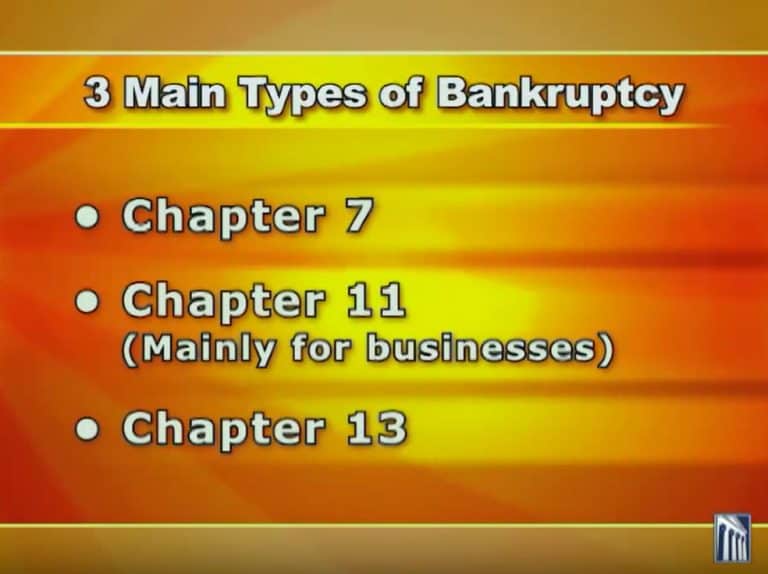

Are you struggling with overwhelming debt, creditor harassment, or the threat of foreclosure? The experienced bankruptcy attorneys at St. Johns Law Group in St. Augustine, Florida are here to help you take control of your financial future. Whether you’re considering Chapter 7 bankruptcy, Chapter 13 reorganization, or need assistance negotiating with creditors, our legal team is committed to finding a solution that works for you.

🏛️ Comprehensive Bankruptcy & Debt Relief Services in St. Augustine

Our firm represents individuals, families, and small business owners in St. Johns County and throughout Northeast Florida. We provide personalized legal advice and representation for:

Chapter 7 Bankruptcy – Liquidation of debt for qualified individuals and families.

Chapter 13 Bankruptcy – Repayment plans that allow you to keep your home and assets.

Foreclosure Defense – Legal strategies to stop foreclosure and protect your property.

Debt Negotiation & Settlement – Reduce or restructure your unsecured debts.

Creditor Harassment Protection – We help stop aggressive collection tactics under the FDCPA.

Wage Garnishment Relief – Halt or reduce garnishments that impact your income.

We utilize advanced legal software to streamline the filing process—ensuring accuracy in complex calculations like the Means Test, which determines eligibility based on your current monthly income.

Affordable Legal Help

If you choose to file for bankruptcy, we offer competitive and affordable fees. For Chapter 13 filings, we may even defer part of your legal fees and include them in your reorganization plan payments—so you can focus on getting back on your feet.

Personal & Business Bankruptcy Services

Bankruptcy is designed to give honest individuals and businesses a fresh start—either by eliminating certain debts or by providing a structured way to repay them over time. Our goal is to reduce your debt and protect your assets.

👨⚖️ Why Choose Our St. Augustine Bankruptcy Lawyers?

At St. Johns Law Group, our local bankruptcy attorneys understand Florida’s complex debt laws and how to leverage them to your benefit. We offer:

Free initial consultations

Deep knowledge of Florida bankruptcy law

Aggressive legal protection against creditors

Tailored debt relief strategies

Experience in North Florida

Helpful Bankruptcy Resources

🏛️Middle District of Florida Local Rules

🎓Personal Financial Management Course Certification

Debt Relief That Understands Your Situation

Financial difficulties can stem from job loss, medical expenses, business failure, or economic changes such as inflation. Whatever the reason, you’re not alone—and relief is possible. Our attorneys understand that everyone makes mistakes or faces hardships, and we are here to provide compassionate, professional support.

💡Did You Know?

Filing for bankruptcy offers immediate legal protection under the Bankruptcy Court’s automatic stay. This powerful tool means that, in most cases, creditors must immediately stop all collection efforts, including:

📞 Harassing phone calls

💸 Wage garnishments

⚖️ Lawsuits

🧾 Collection activities

This protection gives you the breathing room you need to regain control of your finances without constant pressure from creditors.

📚 Frequently Asked Questions (FAQs)

What type of bankruptcy is right for me?

It depends on your income, debt level, and asset structure. We’ll help you decide between Chapter 7 and Chapter 13.

Can bankruptcy stop foreclosure in Florida?

Yes. Filing for bankruptcy can temporarily halt foreclosure and give you time to reorganize your finances.

How long does bankruptcy take?

Chapter 7 cases typically take 3–6 months. Chapter 13 plans last 3–5 years.

🎥Bankruptcy Video Series

Click the image below to watch our introductory video explaining your bankruptcy options. You can also access the full Bankruptcy Basics Video Series provided by the United States Courts to better understand the process.

📞 Schedule a Consultation Today

Speak with an experienced bankruptcy attorney at St. Johns Law Group. We offer consultations in person, by phone, or via Zoom/Teams.

Contact Us:

- 104 Sea Grove Main Street | St. Augustine, Florida 32080